Medical payments, or personal injury protection (PIP) coverage is not required for motorcyclists in Florida – but only drivers of four-wheeled vehicles must have $10,000 of PIP to legally drive. However, given that motorcyclists are 28 times more likely to die in a vehicle accident per mile traveled, and also much more likely to suffer […]

Non-Owned Vehicle Coverage With Commercial Auto

It is a very common thing for owners of commercial vehicles to also need to occasionally, or in some cases on a regular basis, use vehicles they do not own for business purposes. This is why it’s important to ensure your fleet insurance includes non-owned vehicle insurance that is appropriate to your needs. Some commercial […]

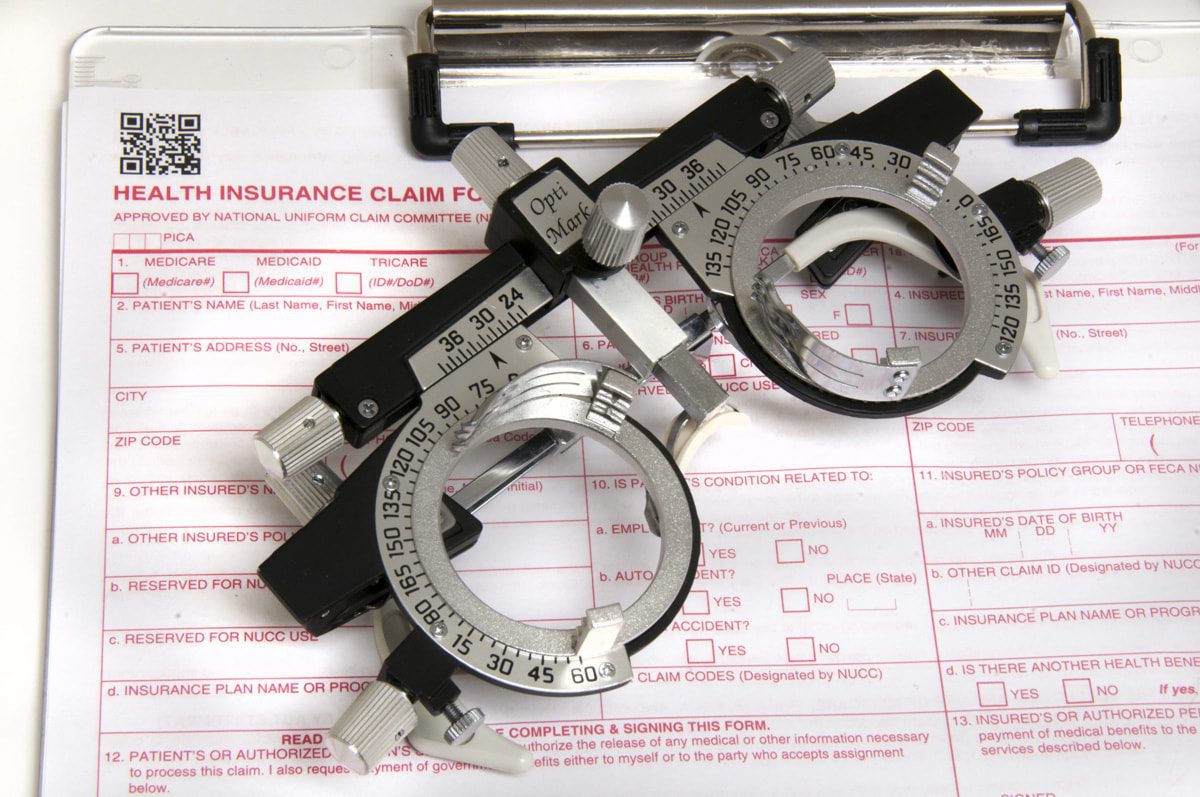

5 Facts Everyone Should Know About Vision Insurance

Your eyes are worth protecting, and the fact is, serious eye diseases like cataracts or glaucoma become significantly more common as people age – so it’s always better to get locked into a low rate on your vision insurance as early as possible and for as long as possible. Although vision insurance is a fairly […]

Does Motorcycle Insurance Cover Passenger Injuries?

Even when you realize that your motorcycle insurance will cover you for personal injury or property damage liabilities, and maybe even for damage to your own bike under a comprehensive policy, there may be one “loose end” you’ve totally overlooked – injuries to others riding on your motorcycle. There are two basic situations where someone […]

How Dental Insurance Can Save Your Teeth

Once reason to invest in dental insurance is to save money, and in many cases you will over the long run, but there’s another even more basic reason why dental insurance is important – it can help you save your teeth. It’s true that dental insurance involves a monthly premium, and with multiple people on […]

4 Factors Affecting The Cost Of Homeowners Insurance

It’s no secret that Florida has some of the highest homeowners insurance rates in the nation, and that may tempt some to go without coverage or skimp on their policy – but that can be a big mistake, costing you more in the long run when a fire, hurricane, tornado, or severe wind storm does […]

How To Save On Boat Insurance In Florida

In Flagler County alone, there were over 5,500 registered personal watercraft (PWCs) in 2016, and Florida is easily one of the most boat-abundant states in the US. Boats seem almost as common as cars in the Sunshine State! You don’t technically have to buy boat insurance under Florida law. Regulations only require your vessel be […]

Pet Insurance For Hereditary Health Problems

While pet insurance coverage for US pets is growing at a rate of around 10% to 15% per year, there are still only around 1% of pets who are insured. With so few familiar with how pet insurance works, it’s not surprising if people are unsure what it does and does not cover. One thing […]

Why Add Lay UP Cover To My Motorcycle Insurance Policy?

Not everyone who owns a motorcycle drives it all year round. Many put their bike into storage for the winter or for multiple months during some other time of year. The question naturally arises, “Do I need to pay for full cover for my bike when I’m not even using it?” But on the other […]

The Importance Of Annual Eye Exams

One of the key, basic benefits of a vision insurance policy is a free or steeply discounted annual eye examination. Aside from helping you save money on contacts or on eyeglasses, vision insurance will save you on the exam needed to get the prescription. You can get any type of eye exam needed and it […]